One has to facilitate different terms like “payment aggregator” and “payment gateway,” which are frequently used in online payments. It is crucial to understand these two concepts and to decide whether Zupain is the right solution for the business. Let us understand where they are located and how the structures work or operate.

Understanding Payment Gateways

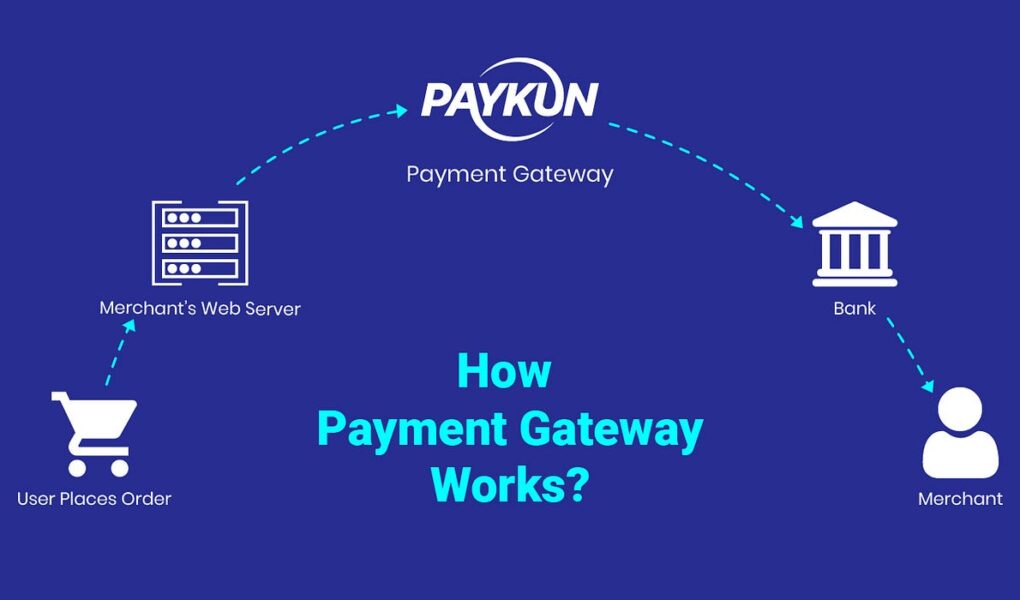

A payment gateway is an application that enables customers to make payments on the website and is useful for merchants. Serving as an online connection, it safely forwards payment details from the customer to the acquiring bank. The first function of a payment gateway is to approve the transaction, which means checking whether the given payment details are correct and whether the purchase amount can be charged from the customer’s account. It includes activities such as encrypting credit card numbers to reduce fraud cases.

Payment gateways are vital for business establishments that accept products through the Internet. They connect to e-commerce stores and offer a smooth attitude at the checkout. However, the integration of payment gateways means that it means having a direct contract with the bank and following compliance procedures. It remains a multifaceted and time-consuming process when applied by small business entities.

Exploring Payment Aggregators

Payment aggregators make the process much simpler by allowing a variety of merchant payments to use a single payment processor account. Rather than every merchant having its account, the payment aggregator comes with an account through which all merchants’ transactions are processed. This model is valid, especially for SMEs and startups. It helps minimize the overhead caused by the establishment of an online payment method.

A payment aggregator allows the management of an organization to start accepting payments and processing transactions within a shorter period without enduring the approval process and creating a merchant account for each account. Another advantage is that the aggregator handles all relations with the banks and card networks, which may be advantageous. Also, several payment aggregators include extra services such as fraud management, analytics, and multiple payment options for clients, thus simplifying the payment process.

Conclusion: Choosing the Right Solution

While choosing between a payment gateway service provider and a payment aggregator, a business considers its capacity and requirements. Based on the payment methods, payment gateways provide direct control and may have lower charges for the highest volumes for large businesses. However, payment aggregators offer convenience, quicker integration, and other services that are suitable for businesses that are small or those that are relatively new to the industry.

Ultimately, the right choice depends on the unique requirements of your business. If you prioritize ease of setup and lower initial costs, a payment aggregator might be the right choice. By understanding the payment aggregator vs payment gateway differenceand the benefits of each option, businesses can make informed decisions that enhance their payment processing capabilities and support their growth. For a streamlined, efficient, and secure payment solution, exploring these options is crucial in today’s digital marketplace.